Need quick cash but need to dodge the hassle? TraceLoans permits simple borrowing without any complaints. Whether you would like some money for personal costs, business investment, or debt repayment, we assist you in getting to the advance that fits you best in no time at all. No more complicated language or hidden fees!

TracLoan.com permits loan comparison in one place, where you’ll check intriguing rates and discover the most excellent alternative. And if that’s not sufficient, our advance tracker app lets you track your installments and due dates and adjust in real-time so you’ll remain educated and never miss an installment.

TraceLoans is simple, secure, and stress-free, which is why it works! Are you prepared to require control of your accounts? Sign up nowadays and get involved in a more inventive way to borrow and oversee advances!

TraceLoans.com Loan Eligibility Calculator

Loan Eligibility Calculator

TraceLoans.com EMI Calculator

Loan EMI Calculator

History Of TraceLoans

The beginning of TraceLoans was to form loans easily for everybody. In days gone by, handling a credit application was time-consuming. There were dull forms to fill out and days to hold up for a reply. Most people found focusing on the proper loan difficult, and keeping track of installments was confusing.

This concept led diversely experienced financial industry experts to create TraceLoans. It is a basic online application that makes a difference. Borrowers discover, compare, and apply for credits in minutes. There’s no uncertainty, no covered-up charges, and a quick way of getting a loan.

In time, TraceLoans.com licensed a loan tracking instrument. Users can see their installment records, due dates, and advance balances at their fingertips, putting them within the driving situate when taking care of their cash and anticipating missed payments. Nowadays, TraceLoans.com proceeds to develop, giving individuals the control to borrow and track advances. Applying for an advance has never been simpler with TraceLoans.

Minimum Eligibility Criteria For TraceLoans

Here’s the minimum eligibility criteria for getting a business loan at TraceLoans.com:

| Requirement | Details |

|---|---|

| Business Age | At least 6 months old (some loans require 1+ year) |

| Annual Revenue | Minimum $50,000 (varies by loan type) |

| Credit Score | At least 550 (higher scores get better rates) |

| Business Type | Must be a registered business in the U.S. |

| Bank Statements | Last 3–6 months of business bank statements |

| Collateral | Needed for secured loans (not required for unsecured loans) |

Latest TraceLoans Posts

How To Use TraceLoans

Utilizing TraceLoans is simple and makes overseeing loans a chunk of cake. Here’s the strategy for that.

- Access the Site: Log on to the TraceLoans site using your computer or smartphone.

- Browse Loan Types: Browse through the different loan types advertised: personal and business loans.

- Loan Calculator: Calculate your monthly repayments by contributing the sum and term.

- Online Application: Fill out the application with your personal and financial details.

- Submit Documents: Give all required reports, such as proof of personality or income.

- Please hold up for Approval: Endorsement is ordinarily gotten shortly after sending it.

- Money credited: In case of approval, the credit is credited to your bank account.

- Observe Loan Status: The TraceLoans account will track each pay and adjust.

- Pay Back the Loan Amount: Repayment would concur with the plan, taken after by an opportune installment through the system.

- Look for Offer assistance If Required: In case of inquiries, contact TraceLoans client benefit for help.

This is how you can work effectively for the borrowing needs of TraceLoans.

Loans Offered By TraceLoans.com

Student Loans

TraceLoans.com offers a different range of choices for student loans to finance education. Whether seeking after undergraduate or graduate ponders, they interface you to banks with competitive interest rates and adaptable repayment terms.

By utilizing TraceLoans.com, you’ll compare diverse loan items to see which would best fit your financial needs. The application handle is clear. The site gives assets that direct each preparation, guaranteeing you make instructive, instructive financing choices.

Personal Loans

TraceLoans.com offers personal loans that cater to a broad financial need. Whether for debt consolidation to cover spontaneous costs or fund a buy, their framework interfaces you specifically with banks prepared to offer reasonable rates and versatile terms.

You can rapidly get an application made, and assets are accessible on TraceLoans.com to encourage understanding every loan’s conditions so that making the correct choices around your accounts is conceivable.

Business Loans

TraceLoans.com expressly offers business loans for business visionaries and business owners aimed at helping a company develop and meet operational needs. Their loan items interface with loan specialists for lines of credit, gear financing, and, indeed, working capital credits.

TraceLoans.com targets making a difference by raising reserves to extend your business operations with competitive, intrigued rates and reimbursement adaptability.

Auto Loans

TraceLoans.com gives auto loans, helping you fund that car you might need to purchase another. Its loan-finding location matches you with banks that can grant you competitive rates and simple terms, so it’s less demanding to discover a loan that suits your budget.

TraceLoans.com streamlines buying you, to begin with, unused or older cars, and it certainly gets you pre-approved to shop.

Mortgage Loans

TraceLoans.com helps you purchase your dream home through mortgage loans. Their online framework interfaces you with loan specialists advertising several items like settled and flexible mortgages.

The company employs competitive interest rates along with personal care to guarantee a simple encounter when buying a house. They provide you with access to assets to teach you about loan choices and how to apply.

Medical Loans

TraceLoans.com helps with medical costs through simple medical loans. Their location interfaces you with loan specialists advertising low interest rates and adaptable repayment choices for anything from surgery, dental care, or other medicines.

You can compare distinctive medical loans with each other to discover one that suits your needs best. It is simple to explore through the site and will direct you through the method before applying.

Construction Loans

TraceLoans.com offers construction loans on simple terms for homes and businesses. These loans are fundamental as the site interfaces you straightforwardly with loan specialists who give both brief- and long-term loans to finance your development.

Get all the stores you need to total construction work at competitive rates and helpful repayment plans. TraceLoans.com helps you get it and apply it with certainty.

Lawsuit Loans

If you’re holding up for a settlement on your lawsuit, TraceLoans.com gets you a lawsuit loan. These credits allow you cash up front to pay bills and other costs, whereas your case is challenged in court.

The website connects you with loan specialists who offer appropriate terms so you’ll comfortably hold up for the settlement without stressing about money.

Agriculture Loans

TraceLoans.com gives agriculture loans to ranchers and farmers. These loans offer assistance in buying land and cultivating hardware, seeds, or seasonal food.

It interfaces you with loan specialists with adaptable terms and lower intrigued rates. Get the proper credit for your cultivation and forward your application rapidly.

Home Equity Loans

Home equity loans complement TraceLoans.com, making a difference when you borrow cash against your home’s worth. The loan can be utilized for domestic repairs, debt installments, or major uses.

The site links you with loan specialists who offer sensible rates and reimbursement terms. Also, the bounty of helpful directions can give you an understanding of how home value advances work.

Bridge Loans

If you would like cash rapidly, whether to offer a domestic or finish off a deal, TraceLoans.com gives bridge loans in a pulse. These short-term advances put money in your hand at a critical minute.

Further, this site connects you with banks that offer adaptable reimbursement alternatives that permit you to bridge financial crevices comfortably and without stretch.

Payday Loans

TraceLoans.com successfully helps individuals needing pressing loans, whereby payday loans come into play. If you need cash nowadays earlier to your following paycheck, the site interfaces you with moneylenders who proffer quick and basic credits.

Application handling is done inside the twinkle of an eye, whereas assets to prepare you with understanding are advertised on the location before borrowing.

Interest Ratio Of Loans

| Loan Type | Interest Rate Range | Best For |

|---|---|---|

| Business Loan | 5% – 25% | Expanding or managing a business |

| Personal Loan | 6% – 36% | Any personal financial needs |

| Home Loan (Mortgage) | 3% – 8% | Buying a house |

| Auto Loan | 4% – 15% | Purchasing a car |

| Student Loan | 4% – 12% | Paying for education |

| Credit Card Loan | 15% – 30% | Short-term expenses, high interest |

| Payday Loan | 100% – 400% | Emergency cash, very high interest |

Main Competitors Of TraceLoans

| Company Name | Description |

|---|---|

| LendingTree | A comprehensive online marketplace that connects borrowers with multiple lenders offering personal, business, and student loans. |

| Upstart | An online lending platform that uses artificial intelligence to provide personal loans to individuals with varying credit histories. |

| Prosper | A peer-to-peer lending platform that allows individuals to invest in personal loans, offering competitive rates and terms. |

| SoFi | A financial technology company offering personal loans, student loan refinancing, and other financial products at competitive rates. |

| Avant | An online lending platform specializing in personal loans for individuals with less-than-perfect credit, offering quick approvals and funding. |

Key Features Of TraceLoans

TraceLoans has easy, user-friendly borrowing features.

- Easy Online Application: Apply for a loan from the comfort of your computer or mobile. There’s no need to walk to a bank for one.

- Fast Approval: Find out within a few hours whether you’ve been approved. Then get that money to put towards something speedy.

- Easy Payment: Decide how and when to make a payment for ease in loan repayment.

- Real-Time Loan Tracking: View your loan status, payments, and remaining balance at any point through your dashboard.

- Transparent Terms: All details about your loan, no hidden fees in clear terms, so nothing surprises you.

- Secure Data Protection: Your personal information is safe, with robust security measures to keep your data private.

This is how TraceLoans equips its borrowers with a smooth and trusted borrowing experience.

Benefits of TraceLoans.com

- Fast and Simple Application

- Variety of Loan Options

- Competitive Interest Rates

- Secure Transactions

- Flexible Repayment Plans

- Real-Time Loan Tracking

TraceLoans.com has an easy, fast online application handle where a loan candidate may apply online by sitting at home without visiting a single bank. You can select from personal, business, or emergency loans agreeing to your monetary necessities at extraordinary interest rates with transparent terms and conditions.

Strong security covers all your personal and financial data while browsing the website, thus setting peace of intellect. Adaptable repayment plans are accessible and can be easily fit into your plan.

Moreover, TraceLoans keeps track of credit installments in genuine time through its dashboard, allowing you to helpfully see installments made, due dates, and your remaining adjustments.

Considerations Before Applying for TraceLoans

- Interest Rates

- Fees

- Loan Terms

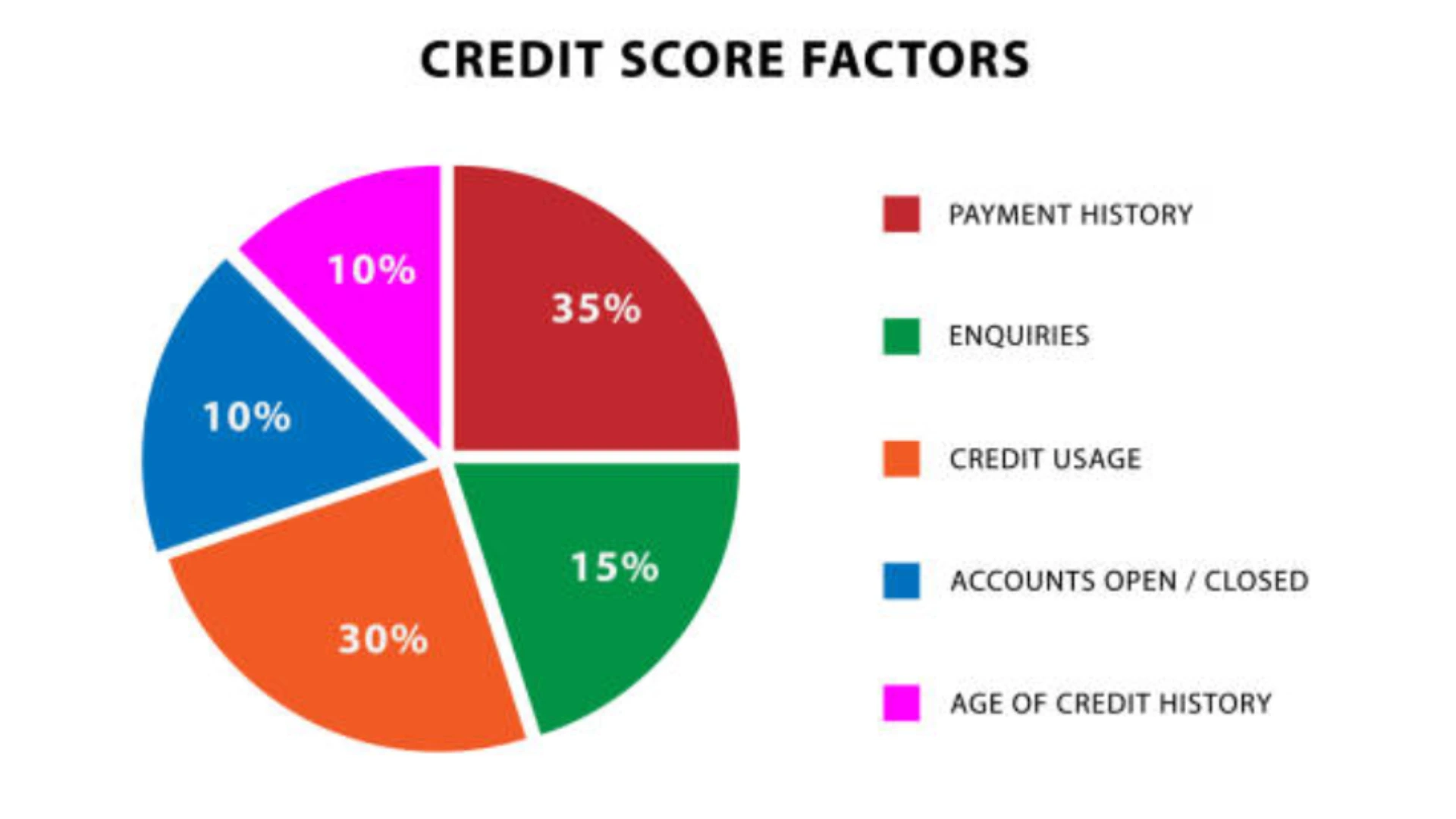

- Credit Impact

- Repayment Obligations

Comparatively, interest rates may shift, and a loan from another loan specialist might draw in a higher or lower interest rate. Additional charges may moreover be included in a few loans, such as beginning expenses, late expenses, etcetera, making it vital to examine the fine print before committing. That’s why Loan terms must harmonize with one’s budgetary circumstances to maintain a strategic distance from defaulting installments due to failure.

Applying for a loan can affect your credit score, particularly in case you have numerous applications in a short time. In conclusion, you’ll be guaranteed to be able to meet the reimbursement plan, as failure to form installments may bring about punishments and antagonistic impacts on your credit history. Considering these components will empower you to make an educated choice before applying for credit with TraceLoans.

What Is Traceloans.com Bad Credit Payment?

TraceLoans.com is an online source that interfaces awful credit people with loan specialists who allow personal loans. It administrations those who cannot discover acknowledgment at conventional banks because of poor credit. The stage works by having clients fill a web application with essential data such as salary and work status.

After this, TraceLoans.com joins candidates with loan specialists willing to consider their application despite their low credit scores. In any case, it is basic to note a caution. A few clients have detailed negative encounters with particular moneylenders. Hence, comparisons must be drawn among different banks sometime recently finalizing one.

Before applying, one should survey the terms and conditions, intrigued rates, and reimbursement terms to maintain a strategic distance from shock expenses or less favorable terms. Investigating distinctive loaning stages can offer assistance in discovering the leading alternative for one’s needs.

What Is Traceloans.com Debt Consolidation?

TraceLoans.com is an online loaning web platform that interfaces borrowers with an arrangement of loan specialists advertising solidified loans for debt consolidation.

Debt consolidation includes combining numerous obligations into one credit, making it less demanding for borrowers to reimburse with decreased intrigued rates. The consolidation of obligations empowers borrowers to oversee their repayment duties in a more stress-free way, sparing time.

How TraceLoans.com Debt Consolidation Works

- Submit Your Requirements: Start by providing information about the type of loan you need, the amount, and your financial details.

- Receive Loan Offers: Once your information is submitted, lenders from TraceLoans.com’s network will provide loan offers tailored to your needs.

- Compare and Choose: Review each offer’s interest rates, repayment terms, and conditions. Decide which choice best fits your spending limit.

It’s important to note that TraceLoans.com acts as an intermediary, connecting you with lenders rather than issuing loans directly.

What Makes TraceLoans Stand Out?

- Transparency

- Tailored Loan Options

- Fast and Easy Approval Process

- Competitive Interest Rates

- Expert Guidance and Support

TraceLoans.com is different because it advances transparency, educating the borrower precisely what advance conditions are and what has taken a toll without any covered charges. Numerous loan options are given concurring to an individual’s prerequisites, whether for personal, business, or consolidating purposes.

The application preparation is streamlined, and the quick endorsement handle takes negligible printed and paper-printed material to facilitate the borrowing handle within the speediest conceivable time to get reserves.

TraceLoans.com offers competitive rates, sparing borrowers cash in the long run. In addition, the stage gives a proficient money-related exhortation to direct clients through every step, guaranteeing they make well-informed advance choices. All these highlights combine to form TraceLoans.com, a trusted and open choice for different advanced needs.

How Does TraceLoans Work?

TraceLoans.com has become an online network of lenders and borrowers that provides a straightforward loan application and approval process. This is how it works:

- Application Process: Borrowers start by providing essential information in an online form. The information provided would include name, income, and employment details.

- Credit evaluation: TraceLoans.com assesses a borrower’s creditworthiness based on the aggregate analysis of factors and not merely through credit scores. The assessment criteria include income verification, employment status, and other relevant financial parameters.

- Loan matching: After collecting information from the customer, TraceLoans.com identifies a lender within its network and presents suitable loan options that can meet the requirements and profile of the borrower.

- Approval and Funding: There exists approval of appropriate financing received as well as provision of disbursal of funds after approval generally takes place within 24 hours provided directly into the borrower’s account.

TraceLoans.com applies technology to simplify the borrowing process, thus opening many opportunities for people to gain financial assistance.

Is TraceLoans Safe to Use?

Trust and security are of the most extreme significance at TraceLoans.com. We interface borrowers with trusted loan specialists advertising personal, business, and student loans. Our site utilizes high encryption security to guarantee that your data remains secure so you can apply without stress.

Our clients appreciate the mind-blowing speed and straightforwardness of loan disbursement. Our platform is straightforward, and straightforwardness is kept up for all essential credit data with no covered expenses. We work as it were with endorsed banks who comply with strict industry rules to secure borrowers like yourself.

The advance terms must be checked carefully sometime in the future. Depending on your credit rating and moneylender, these loans might carry a high interest rate. That’s why we offer data unreservedly to guarantee that we can make an appropriate choice that’s right for you.

Future Prospects of TraceLoans

We are continuously attempting to make loan borrowing smoother and faster at TraceLoans.com. As of now, personal, business, and student loans are accessible, but long-term holds exceptionally shinning things!

These advances will be personalized by utilizing innovations such as AI and machine learning so that credit applications can be assessed quickly. Based on their needs, individuals will be advertised exceptionally diverse credits. With joined forces banks we will depend on, we can give more elective loans to individuals with diverse budgets. Your credit history doesn’t matter; we need to provide you with the most excellent loan.

Moreover, we endeavor to make strides by advancing the site’s involvement with simple, user-friendly instruments and learning sources. We point to making borrowing basic, clear, and stress-free so that people can make judicious cash choices!

Conclusion

TraceLoans.com is an online source that interfaces a borrower with loan specialists, and it has an organized assortment of loan items, from personal and business loans to student loans. TraceLoans.com rearranges the advanced application process by leveraging innovation to associate borrowers with banks that can make the most excellent advances to get monetary help.

Whereas most clients have had positive encounters concerning ease of application and competitive rates, some are concerned with rates and fees. One should study the advanced terms before applying them in this manner.

TraceLoans.com will create its administrations by embracing progressed innovations like AI and increment its loaning organization in the blink of an eye to deliver more customized arrangements and much better user involvement. TraceLoans.com may be a great benefit, but borrowers should conduct thorough inquiries about audit terms carefully and consider counseling a budgetary advisor to create informed choices.